ABOUT US

Who we are

Mission

Celebrate Healthcare LLC is committed to ensure that there’s healthcare equity in vulnerable communities. Especially access to adequate healthcare services, Health insurance, workforce development and resources.

Why us?

Celebrate Healthcare LLC is a marketing events and outreach company focused on educating citizens and businesses on the benefits of the Affordable Healthcare Act. We work with municipalities, businesses and organizations to develop comprehensive plans to increase healthcare enrollment by the uninsured.

Founder: Gaylene C. Kanoyton

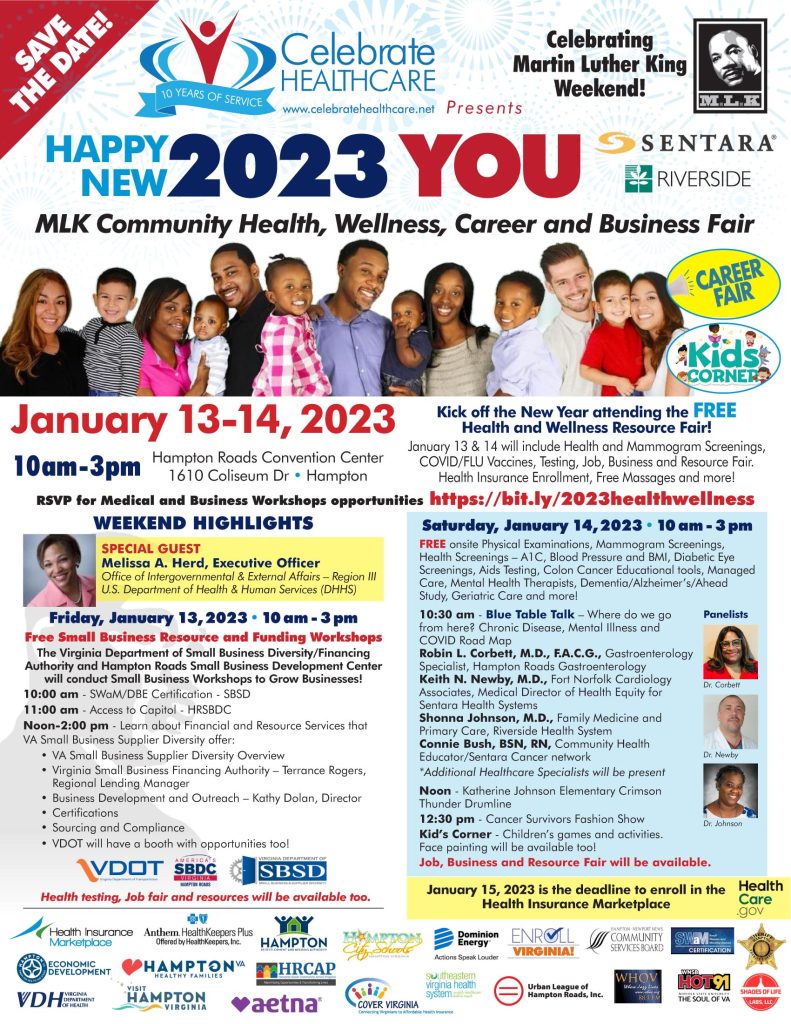

Ms. Gaylene C. Kanoyton has over 35 years of Marketing and public affairs experience. She received her Bachelor of Arts Degree in Political Science from Hampton Institute and graduated from the Civic Leadership Institute in Norfolk, VA. In 2013, Gaylene founded Celebrate Healthcare, LLC, a Health Care Advocacy, Outreach, and Education Agency. She has guided Celebrate Healthcare in its partnership with local agencies/organizations to include organizing over 300 health care enrollment events (Enrollfest) and educating vulnerable populations on the Affordable Care Act and Medicaid Expansion. To date, at least 30,000 people have been reached and over 15,000 people were enrolled in the Affordable Care Marketplace. Gaylene has successfully educated individuals and groups on Medicaid Expansion as well as the importance of voting in not just national elections, but also in local and state elections. She was very active with ensuring Black, Brown and vulnerable populations were COVID 19 tested and ensuring that everyone is vaccinated. She has held over 200 COVID testing and Vaccination Clinics. During the height of COVID-19, she held weekly webinars and virtual 30-Minute Faith Leaders Vax Boost Sessions with health professionals and state leaders to provide updates on the pandemic and available resources. Ms. Kanoyton is currently ensuring that Medicaid insurance members don’t lose coverage by organizing Medicaid Renewal and Enrollment events throughout Hampton Roads, Central and Southside Virginia.

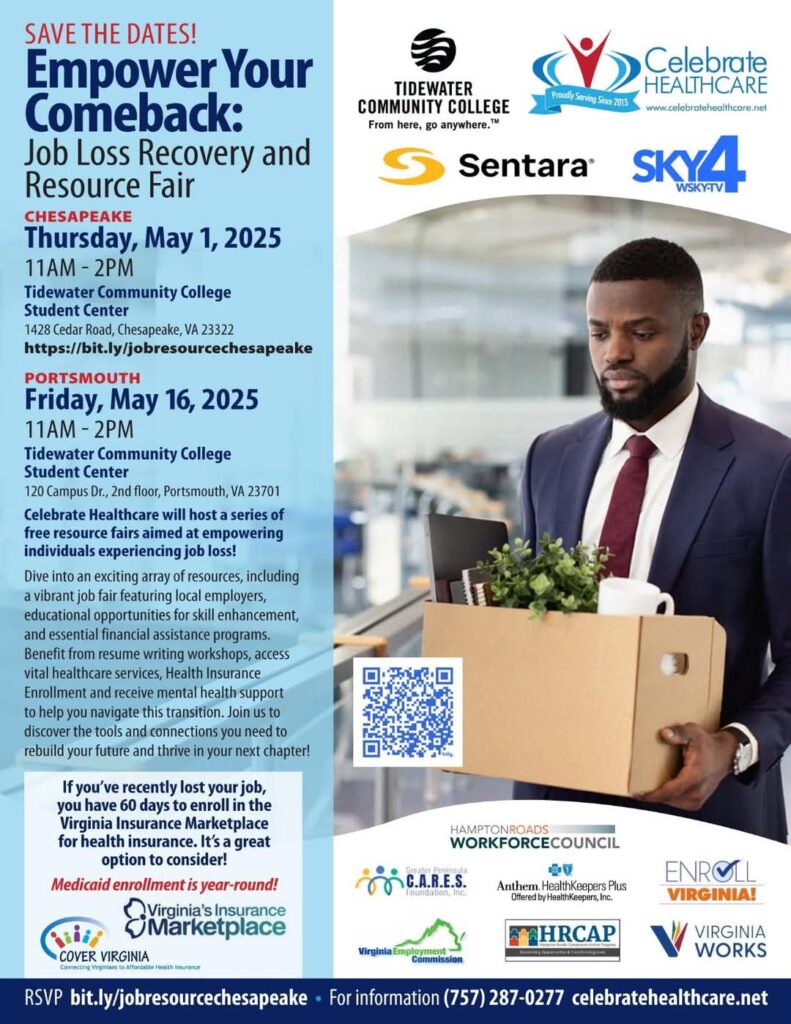

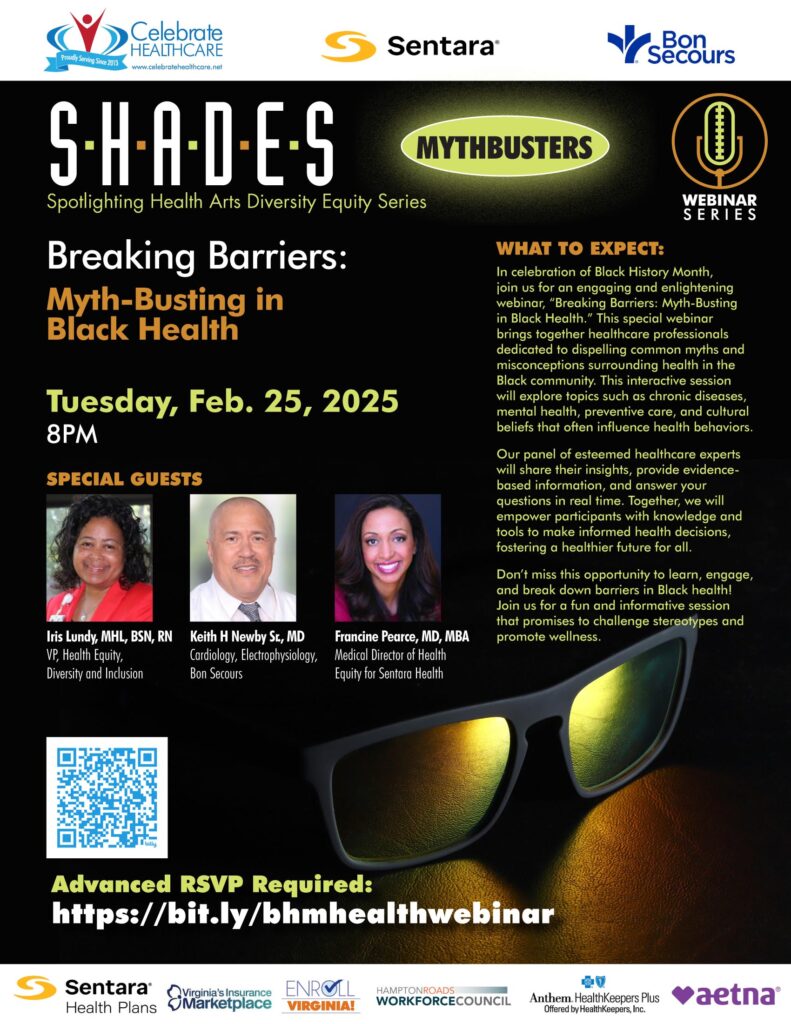

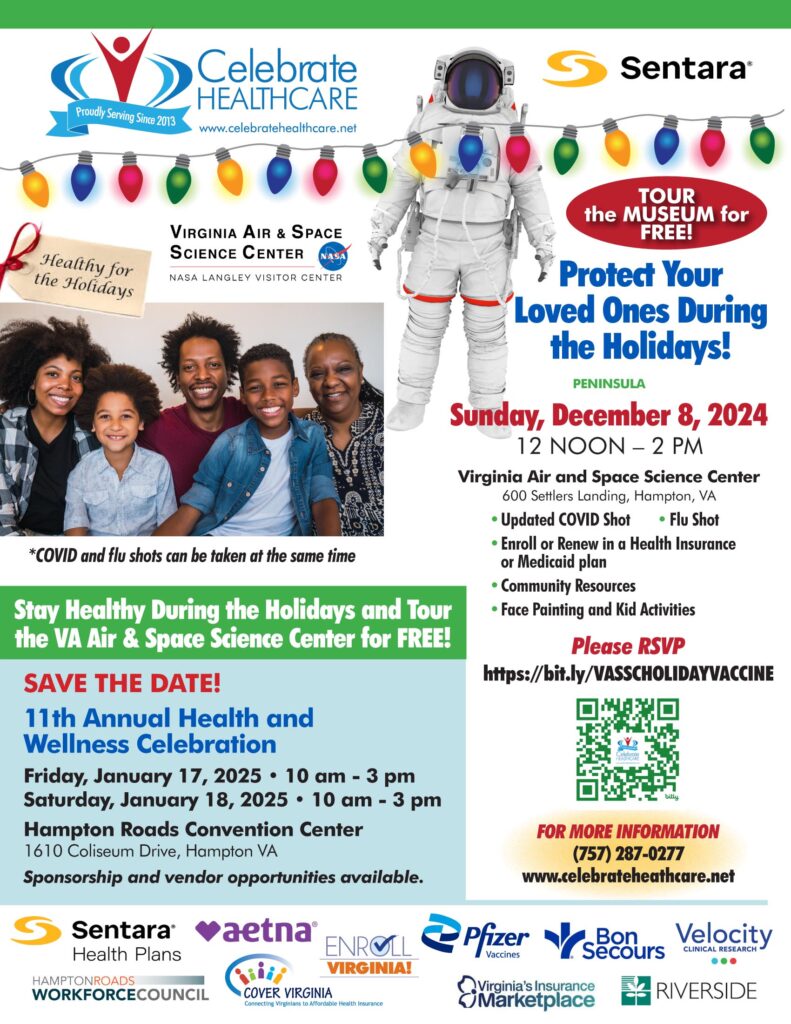

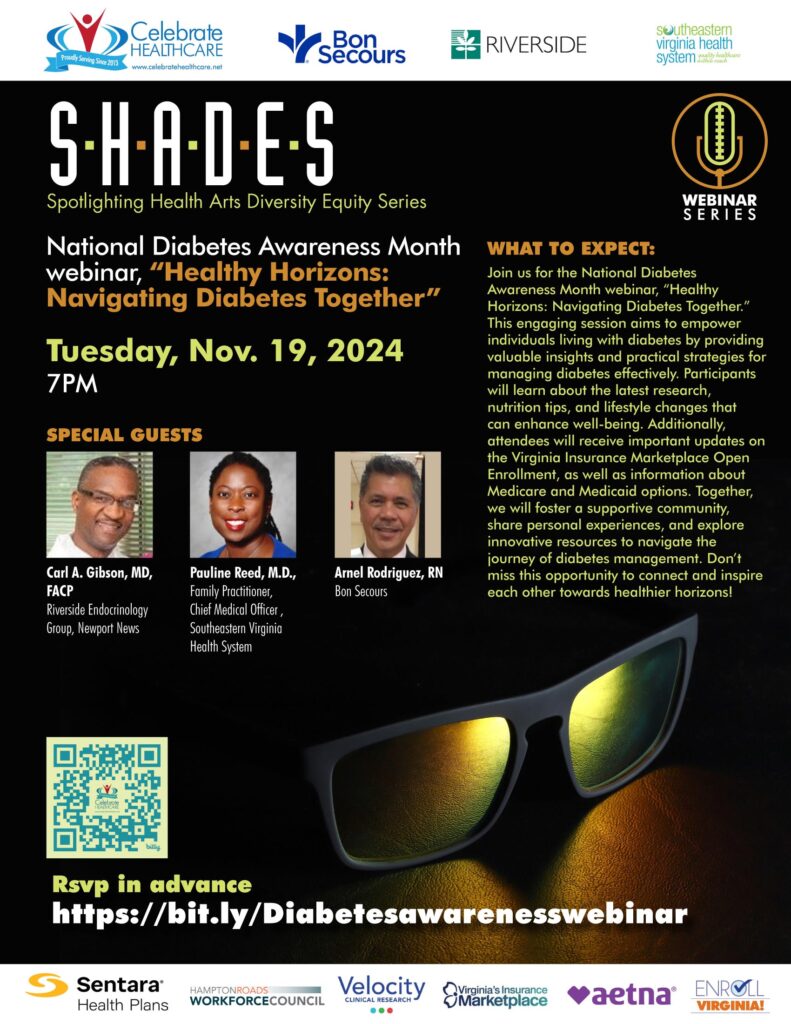

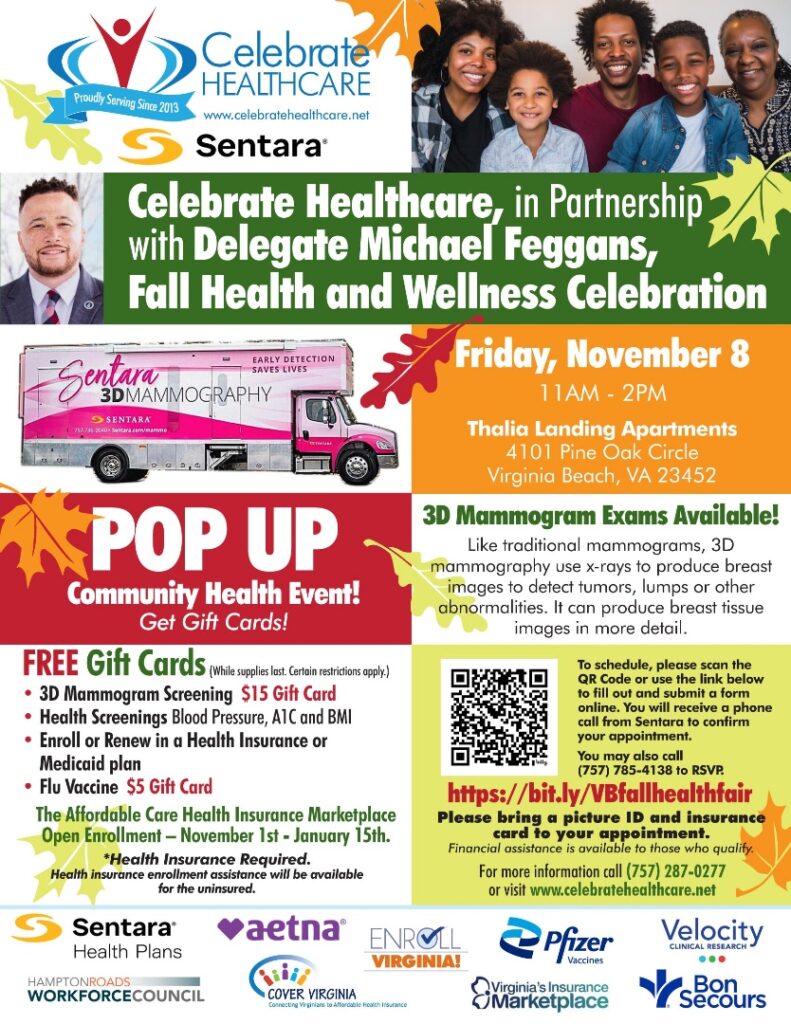

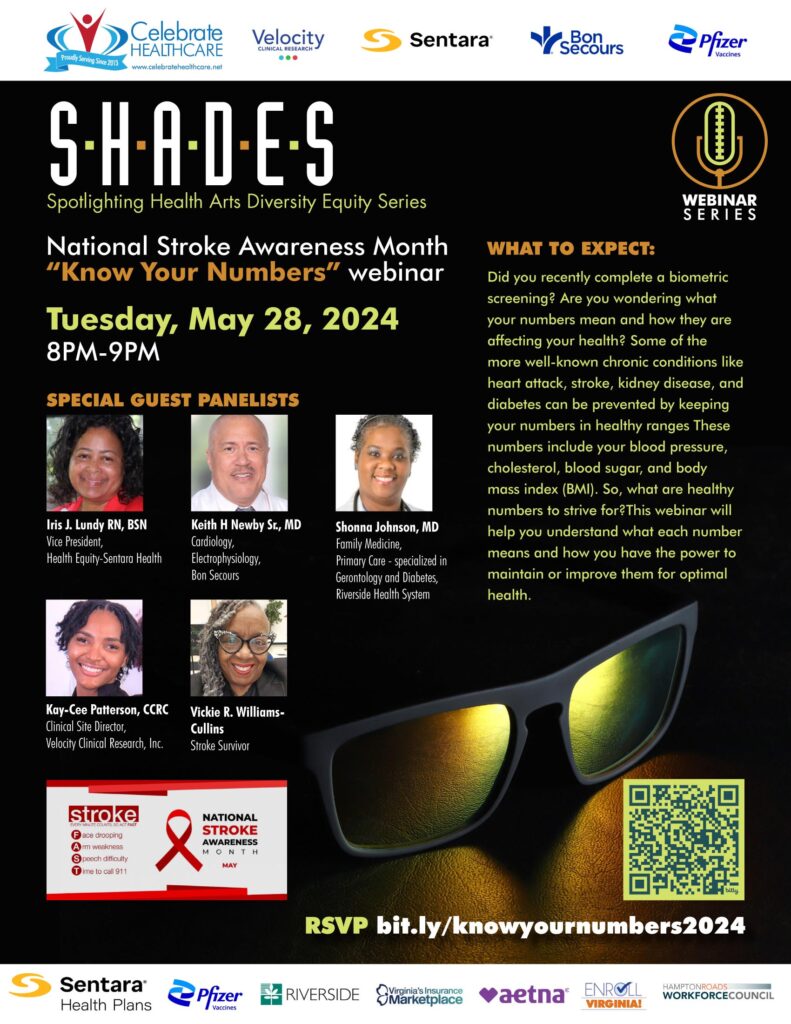

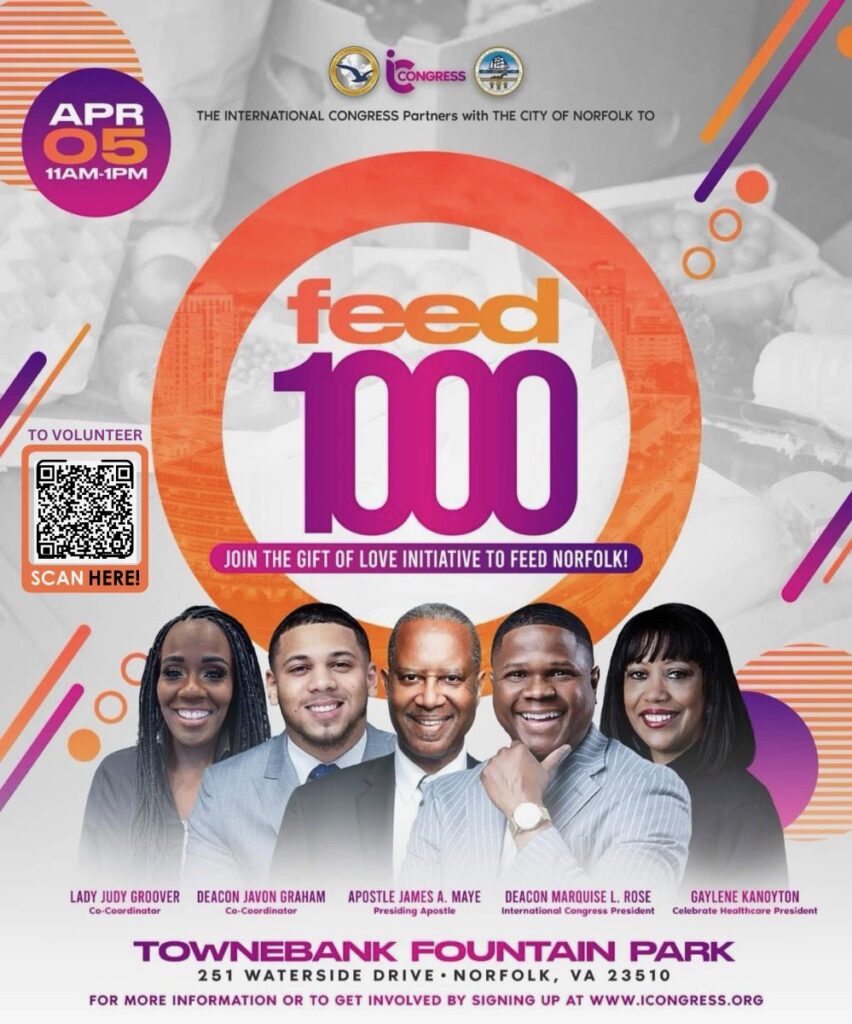

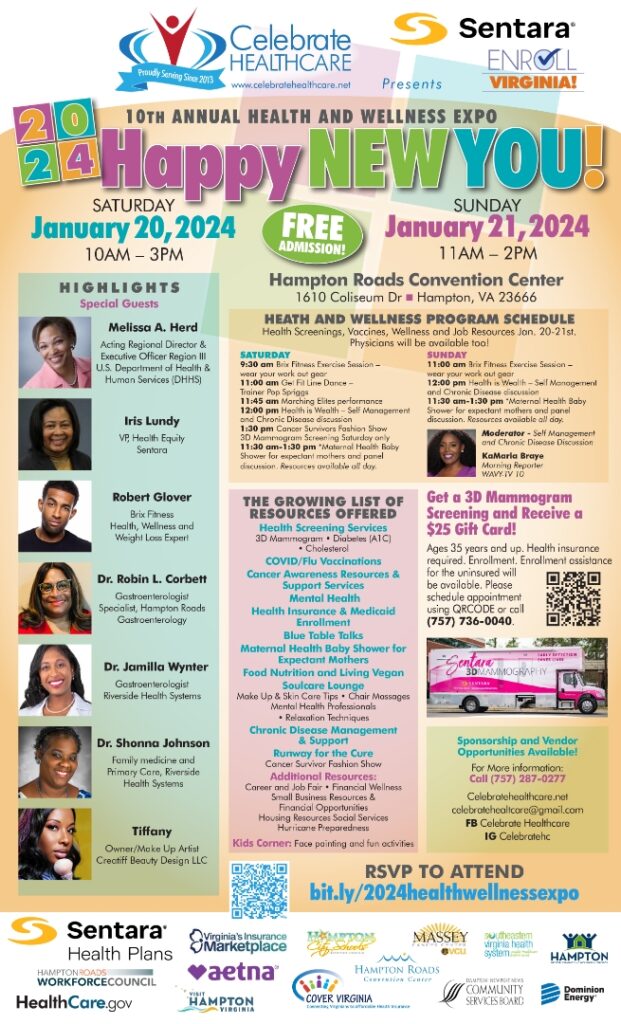

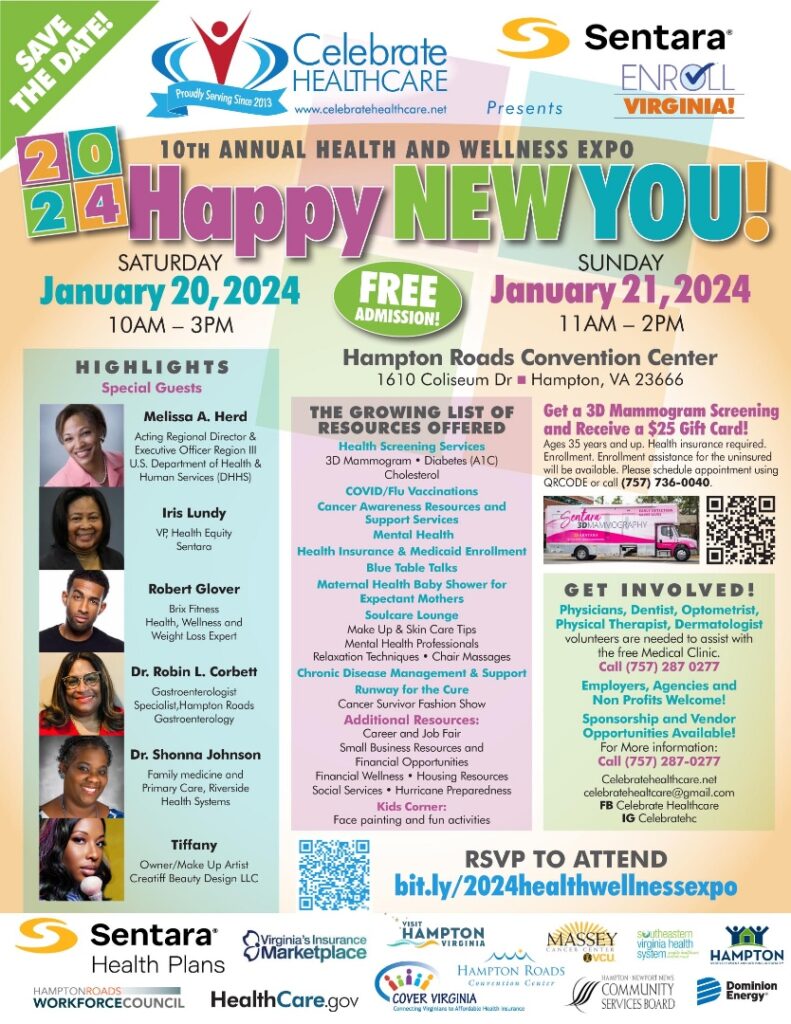

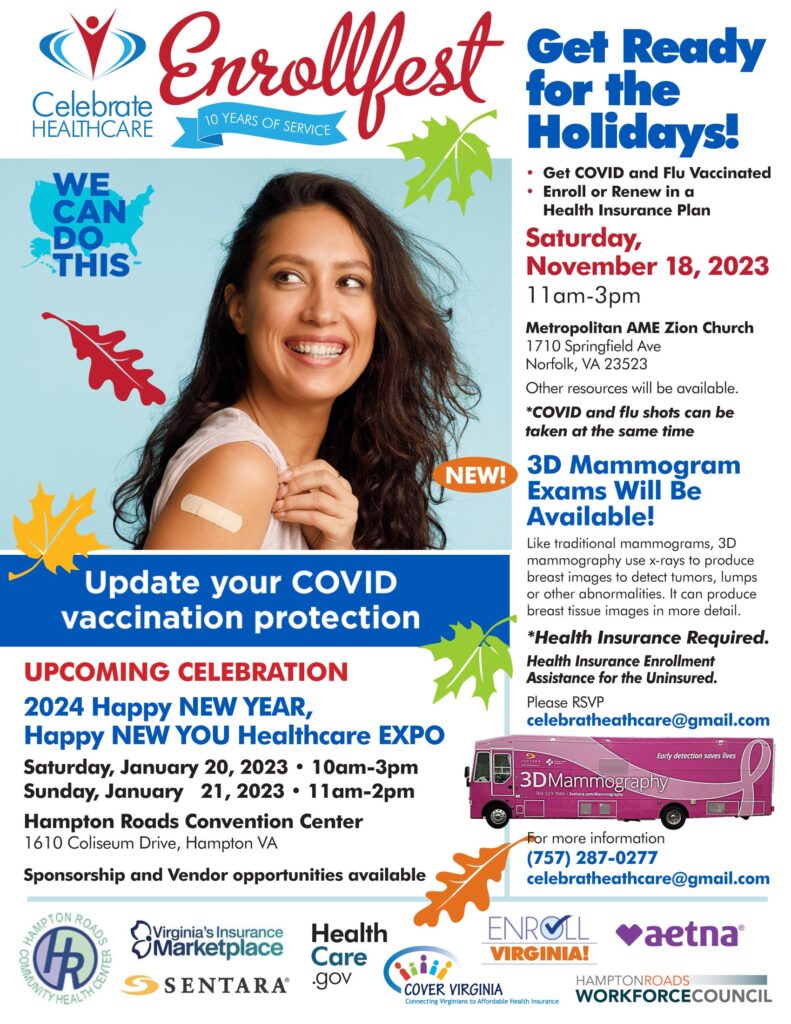

UPCOMING EVENTS

Important Dates

Click on the links below to register:

Our Work in the Community

Facts

Get covered

Get ready to apply for health coverage

Open enrollment begins November 1

Virginia’s Insurance Marketplace will launch November 1st when the Open Enrollment Period begins for coverage starting in 2024. If you are looking for coverage for Plan Year 2023 and have recently experienced a Qualifying Life Event, you may be eligible for a Special Enrollment Period at HealthCare.gov now.

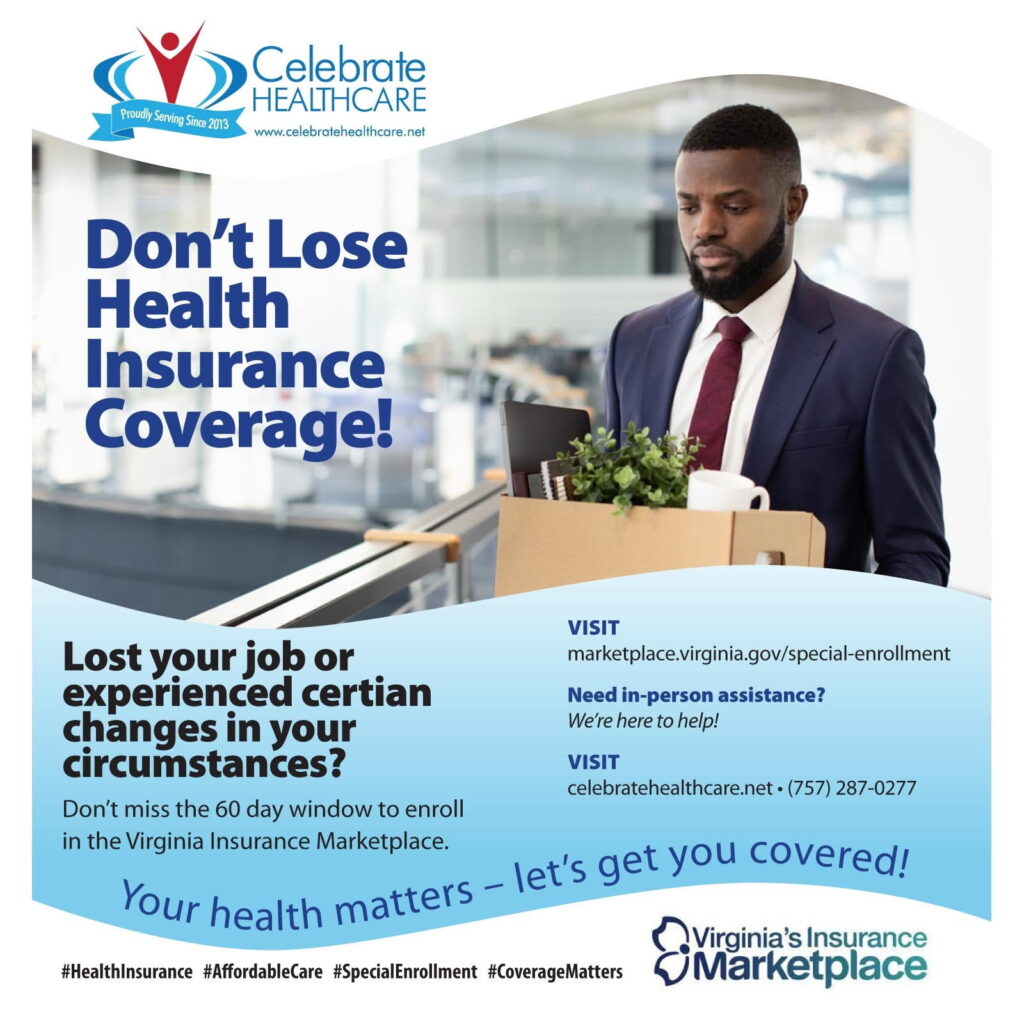

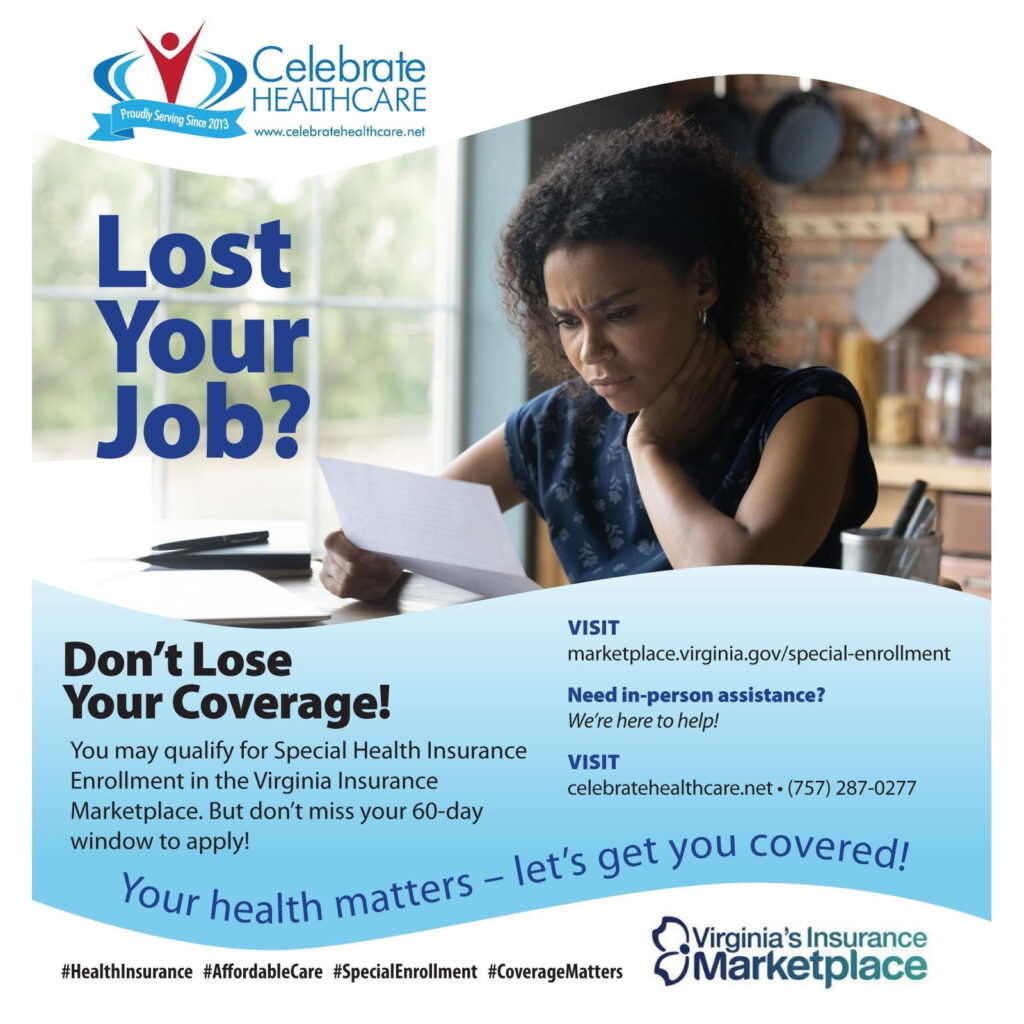

Losing Medicaid Coverage?

You Have Options.

From March 2023 through February 2024, Virginia is reviewing Medicaid health coverage to make sure enrolled members still qualify. If you no longer qualify for Medicaid and lose your coverage, you are eligible to enroll in a new health plan.

Facts about coverage

In some cases, you won’t be automatically re-enrolled. You’ll need to take action to Enroll Renew in a Health Insurance plan between November 1, 2023 – January 15, 2024.

What to know if you’re not automatically re-enrolled:

Update your info

If you don’t update your information frequently, you might wind up with an outdated premium tax credit – or even a plan you’re not eligible for. That’s why it’s so important to update your Marketplace application with any income and household changes – even if you want to keep your current health plan.

Avoid higher rates

If you don’t update, you could pay more each month than you need to, or take a higher advance payment of the premium tax credit than you qualify for. If that happens, you’ll have to pay back some or all of it when you file your federal taxes.

Tax Credits

Remember: Premium tax credits and other savings are based on the income and household information you expect for the current year, not last year’s information.

Celebrate Healthcare Champions

Below are local community Supporters:

let’s work together

Get in touch